Introduction

Top Dallas neighborhoods to watch in 2026 are beginning to stand out as the housing market moves into a more balanced phase. Rapid price spikes are giving way to steadier growth, and data is becoming the most reliable guide for buyers and investors.

Dallas continues to benefit from strong population growth, job expansion, and infrastructure investment. These forces are shaping where demand will concentrate next.

As highlighted in Dallas Real Estate Market Predictions for 2026, the advantage is shifting toward those who use data rather than speculation.

This guide examines the top Dallas neighborhoods to watch in 2026 and explains how to evaluate submarkets with confidence.

2026 Dallas Market Overview

Dallas remains one of the most closely watched housing markets in the country. Demand is still strong, but conditions are becoming healthier and more predictable.

Macro Trends Impacting Neighborhoods

Several forces are influencing neighborhood performance:

- Corporate relocations continue to attract skilled workers

- Infrastructure projects are expanding commuter access

- New construction is improving inventory levels

- Lifestyle migration remains strong

According to the U.S. Census Bureau, Texas continues to lead national population growth, reinforcing long term housing demand.

https://www.census.gov

What Data Signals for 2026

Neighborhood data points to a market defined by selective growth rather than universal appreciation.

Some areas will outperform due to schools, transit access, and employment proximity. Others may see slower gains as supply expands.

Understanding these patterns is essential when choosing where to buy or invest.

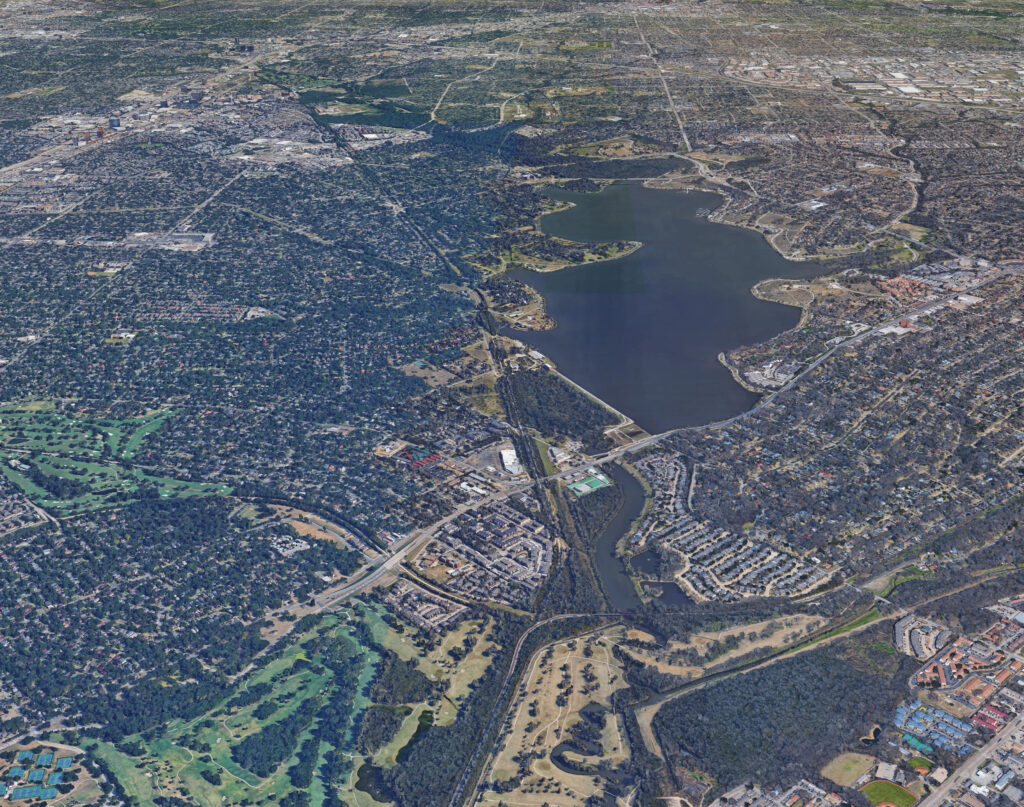

Neighborhood #1 East Dallas and Lakewood

East Dallas and Lakewood combine lifestyle appeal with long term stability. Tree lined streets, access to White Rock Lake, and strong schools continue to attract professionals and families.

Why it stands out:

- Limited housing supply supports pricing

- High owner occupancy strengthens neighborhood quality

- Renovation activity is boosting property values

This area often appeals to buyers seeking durability rather than speculation.

Neighborhood #2 Far North Dallas and the Plano Corridor

The Plano corridor remains a magnet for corporate expansion. Major employers and campus style developments continue to anchor housing demand.

Growth drivers include:

- Strong job concentration

- Modern housing stock

- Highly rated schools

- Continued population inflows

Investors looking for consistent rental demand often prioritize this corridor.

Neighborhood #3 Uptown and Downtown Dallas

Uptown and Downtown appeal to younger professionals and lifestyle driven renters. Walkability and entertainment access remain key advantages.

While urban markets experienced volatility in recent years, stabilization is creating renewed interest.

What the data suggests:

- Strong renter pool

- Increasing return to office activity

- Limited space for large scale expansion

Urban neighborhoods often recover quickly once momentum returns.

Neighborhood #4 Oak Cliff and Bishop Arts District

Oak Cliff continues to transform. The Bishop Arts District has become a cultural anchor, attracting restaurants, retail, and creative businesses.

Key signals to watch:

- Ongoing redevelopment

- Rising buyer interest

- Relative affordability compared to northern suburbs

For investors, this combination often signals long term upside.

As explored in Profitable Investment Deals in Dallas Real Estate 2026, emerging neighborhoods frequently offer stronger entry pricing with future appreciation potential.

Neighborhood #5 Richardson and the University Area

Richardson benefits from educational institutions and technology employment hubs. These anchors create reliable housing demand.

Why buyers are watching:

- Stable rental demand

- Attractive pricing relative to nearby suburbs

- Strong economic base

Markets tied to universities often demonstrate resilience during economic shifts.

How to Use Neighborhood Data to Make Smart Decisions

Understanding the top Dallas neighborhoods to watch in 2026 is only the first step. The real advantage comes from knowing how to interpret the data.

Key Market Metrics to Evaluate

Focus on indicators that signal durability:

- Job growth

- Population trends

- Days on market

- Rent levels

- New construction activity

The National Association of Realtors provides research that helps buyers track these indicators effectively.

https://www.nar.realtor/research-and-statistics

Tools and Sources for Neighborhood Data

Use multiple sources before making decisions. Local MLS data, census insights, and economic reports provide valuable perspective.

Avoid relying on headlines alone.

Aligning Data with Goals

Choose neighborhoods that match your strategy. Cash flow investors may prefer stable rental corridors. Long term buyers may prioritize appreciation potential.

Data is most useful when aligned with clear objectives.

Buyers navigating shifting conditions may also benefit from Buying Your First Home in Dallas During Changing Market Conditions, which outlines how market transitions affect purchase timing.

Common Mistakes to Avoid

Chasing Trends Without Fundamentals

Fast growing neighborhoods attract attention, but growth without economic support can fade quickly.

Always verify the drivers behind demand.

Ignoring Local Seasonality

Housing activity fluctuates throughout the year. Comparing seasonal data prevents misinterpretation.

Skipping Due Diligence

Even strong neighborhoods contain weak properties. Evaluate each deal carefully.

Overconcentrating in One Submarket

Diversification reduces exposure to localized downturns.

Balanced portfolios outperform concentrated ones over time.

Conclusion

The top Dallas neighborhoods to watch in 2026 reflect a market shifting toward stability and strategic growth. Opportunity remains strong, but success now depends on informed decision making.

Buyers and investors who follow the data, evaluate fundamentals, and align neighborhoods with long term goals will be positioned to benefit from Dallas’s continued expansion.

In a market defined less by hype and more by analytics, knowledge is becoming the most valuable investment tool.